What's in a (town) name? Understanding town/city labels in Upstate listings

BY JENNIFER GRIMES

When I bought my Upstate weekend cottage in 2005, I was a complete real estate neophyte. I saw just one house, asked few questions, and didn't attend the home inspection. I told my sister excitedly that I was buying a place in The Catskills in a town called Claryville, and she asked if that was anywhere near Denning, a beautiful place she'd visited a couple of times for a friend's annual weekend gathering. My answer was that it didn't ring a bell.

The Neversink River as it flows through Claryville, Town of Neversink. (Just down the road Sullivan Co. becomes Ulster Co. and the Town of Denning.)

Claryville is a hamlet within the Town of Denning, as it turns out. So for all of you who scratch your heads when you see a “city” and "town" listed for each property, here's the skinny: What you and I would call towns are really “hamlets” grouped together for the purposes of shared government. So rather than every pokey place having their own town hall, elected officials and departments like highway, tax, zoning and that type of thing, they are grouped into municipalities, “Towns”. As in the Town of Denning.

And the hamlets are most closely associated with your mailing address.

Here’s an example: Let’s take the Town of Rochester in Ulster County. (Not the city of Rochester further upstate). It includes Accord, Kerhonkson, and lots of other small communities or “hamlets”. When you get your Town/County tax bill, it’s from that taxing authority , ie Town of Rochester. When the plow truck goes by, which your taxes pay for, it will say Town of Rochester (not Accord, etc.).

Town/County tax bills go out every January, and reflect fees required to cover the budget of that township (or grouping of "hamlets") plus contributions to the county budget. So when looking at real estate listings, the overall rate of taxation by town may be quite relevant as some towns have higher tax rates than others. In Sullivan County, for example, the Town of Neversink has the lowest taxes because of a subsidization deal they reached with the City of New York when the Neversink Reservoir was created (by flooding Neversink) to provide drinking water to NYC.

So when you’re perusing listings, there are potentially four “areas” designated for each property:

• County

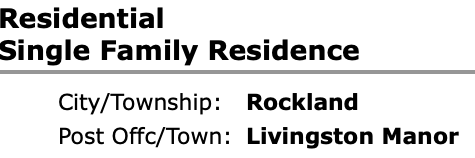

• Township (often listed as “city”). Some of these don’t exist as physical destinations in that they have no zip code. It is a taxing municipality that governs a group of hamlets, ie the Town of Rochester (Accord, Kerhonknson, etc.) or the Town of Rockland (Livingston Manor, parts of Roscoe, etc.).

• Hamlet (often listed as “town”). These most often correlate with zip codes. What you and I would refer to as a town, ie Accord or Livingston Manor.

• School District is a lesser component, but depending on where a property is located, children within the same zip code might find themselves attached to different school districts. And each district taxes based on their budget, so again, rates can vary.

This is how the listing input appears on the MLS, and why you may see more that one “town” name listed per property.

There are 15 towns/municipalities in Sullivan County and 20 towns in Ulster County. But as with all rules, there are some (even more) confusing aspects. Many “hamlets” have sections governed by different towns. In most of Livingston Manor, for example, your tax bill comes from the Town of Rockland, which also governs parts of Roscoe and of Willowemoc. But there are addresses within the Town of Liberty and the Town of Callicoon that are served by the Livingston Manor post office and carry that address even though they’re not in the Town of Rockland. Most people know Callicoon as a terrific business district along the Delaware River. Ironically it is NOT part of the Town of Callicoon; it's in the Town of Delaware. And Callicoon Center, a separate hamlet altogether, IS in the Town of Callicoon. Go figure.

If you’re still scratching your head, don’t feel bad. Zillow, Google Maps and even the MLSs frequently present this data incorrectly and trying to get it fixed is an exercise in futility.

And while we're on the subject, school district boundaries do not always follow town maps. In fact, schools may incorporate several towns and cross over town or even county lines. So the school district, which has its own taxing authority (school tax bills go out every September and are the second half of your annual property taxes), can play a large part in the amount of taxes attached to a property.

Got that?

Jennifer Grimes is the Broker / Founder of Country House Realty.